Top Crypto Gainers Today Apr 30 – Avalanche, SafePal, Waves, Amp

Top gainers like Avalanche, SafePal, Waves, and Amp capture investors’ attention with their remarkable performances in today’s crypto market. But amidst these success stories lies a darker tale of cybercrime. Investigator ZachXBT has unveiled how the infamous Lazarus Group allegedly laundered over $200 million in hacked cryptocurrency funds.

With the assistance of industry leaders, ZachXBT has identified multiple accounts tied to Lazarus Group. This sheds light on their nefarious activities. These include high-profile hacks totaling over $2 billion in stolen assets. This exposé underscores the urgent need for vigilance. It also emphasizes collaboration in the ongoing battle against cybercrime.

Biggest Crypto Gainers Today – Top List

In a bustling crypto market, where the total trading volume in the last 24 hours soared to $455.73 billion, sentiments sway in uncertainty. With the crypto Fear & Greed Index oscillating at 67, tipping towards Greed, the atmosphere remains tempered by caution. While 29% of cryptocurrencies have seen gains, 71% have faced losses, representing market volatility. As investors navigate these fluctuations, today’s top gainers offer opportunities in these shifting tides.

1. Avalanche (AVAX)

Avalanche is a layer one blockchain that serves as a platform for decentralized applications and custom blockchain networks. It competes with Ethereum to become the leading blockchain for smart contracts. It aims to achieve this by offering higher transaction throughput of up to 6,500 transactions per second while maintaining scalability. Avalanche’s unique architecture comprises three blockchains: X-Chain, C-Chain, and P-Chain. Each chain serves specific purposes and employs consensus mechanisms tailored to their use cases.

In recent news, financial infrastructure platform Stripe declared its backing for Avalanche’s C-Chain. This enables retail customers to directly purchase AVAX tokens. Stripe’s customizable widget integrates a fiat-to-crypto onramp into Avalanche decentralized applications (dApps). This broadens options for users to buy cryptocurrencies and fund wallets through ACH, debit, and credit cards. This integration aims to streamline the process for users and Web3 companies, fostering adoption and bridging Web2 and Web3 technologies.

Partnership Announcement #1:

As part of Stripe's expansion to Avalanche, we are proud to announce The Arena is one of the select partners that will integrate Stripe’s fiat-to-crypto onramp.

Through a customizable widget in the app, all users will be able to fund their Arena… pic.twitter.com/yj9F8MHLpZ

— The Arena (@TheArenaApp) April 29, 2024

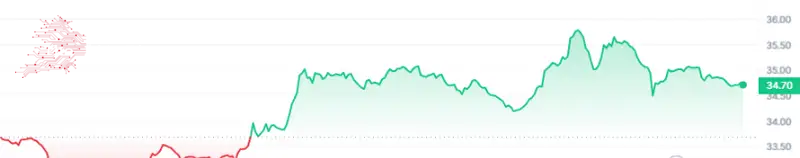

Avalanche has surged 105% over the past year, with a 2.97% increase in the last 24 hours. Currently trading at 120.50% above the 200-day moving average, an overbought 14-day Relative Strength Index (RSI) at 73.86 suggests a possible correction. Market dominance stands at 0.56%, with 11 green days out of 30, showing mixed sentiment. Its 30-day volatility sits at 16%, implying moderate price swings. With high liquidity and a volume-to-market cap ratio of 0.0687, Avalanche remains positioned for growth and adoption.

2. SafePal (SFP)

SafePal is a crypto wallet launched in 2018, providing hardware and software solutions for safeguarding and growing digital assets. Paired and managed through the SafePal App, it was notably the first hardware wallet backed by Binance. It enables users to securely store, manage, swap, and trade their assets without compromising security. Also, it offers support for a wide array of cryptocurrencies, including popular tokens on Ethereum, Binance Smart Chain (BSC), and TRON blockchains.

Moreover, SafePal aims to offer affordable hardware and software wallets, making transactions efficient and secure. The wallet platform consolidates various markets into one app, which enhances user convenience and security. With Binance’s backing, users can access pricing and transaction fee information within the app. Additionally, holders of SafePal’s native token, SFP, receive bonuses and coupons, further incentivizing platform engagement.

🎉SafePal will be receiving 140K $ARB via the @arbitrum #LTIPP Program!🤝

Thank you for the overwhelming support with 99.33% approval from 148 M $ARB votes💙🧡

Stay tuned for incentives for our banking gateway with @Fiat24Account to boost growth in the #Arbitrum ecosystem🚀 pic.twitter.com/xcnnFmsqxM

— SafePal – Crypto Wallet (@iSafePal) April 23, 2024

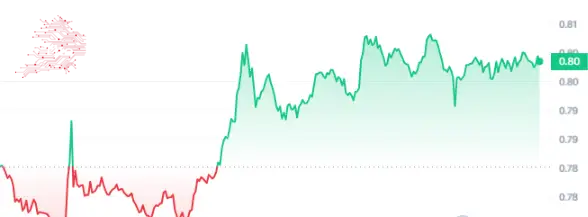

Investors analyzing SafePal’s performance metrics find promising indicators. With an 87% price increase over the past year, SafePal demonstrates upward solid momentum. Trading well above the 200-day moving average by 37.21% further solidifies its position. Despite a neutral 14-day RSI, the prevalence of green days in the last 30 (57%) suggests sustained positive sentiment. Its low 30-day volatility at 7% appeals to risk-averse investors, while high liquidity, with a volume-to-market cap ratio of 0.0663, ensures ample trading opportunities. These factors collectively position SafePal as an enticing investment prospect within the crypto market.

3. 99Bitcoins ($99BTC)

99Bitcoins, a prominent cryptocurrency education platform, has recently initiated its presale of $99BTC tokens, amassing over $850,000 in funding within mere weeks. Users earn $99BTC by completing courses, quizzes, and community activities, redeemable for rewards and staking with a high APY exceeding 2,000%, tapering with increased participation.

With a whopping 533 million $99BTC tokens already staked, it’s clear the community’s confidence in the platform is rock solid. As they gear up to shift from Ethereum’s ERC-20 to Bitcoin’s BRC-20 standard, excitement is palpable. This move promises tighter security and opens new possibilities in Bitcoin DeFi. With curiosity piqued and interest soaring, the stage is set for a surge in demand for crypto education like never before!

Stake your $99BTC tokens today and start receiving rewards! ⭐️

This not only secures the network but also contributes to the platform's liquidity. 🔐

Learn More: 👉 https://t.co/NXD7DAamqr#99Bitcoins #BlackRock $BTC $ETH pic.twitter.com/fx8o9zj4Zj

— 99Bitcoins (@99BitcoinsHQ) April 29, 2024

Furthermore, the 99Bitcoins announces a $99,999 BTC airdrop for presale participants, fostering a learn-to-earn ethos. Users simply register, follow on social media, and provide their Bitcoin wallet address to participate. With a supply cap of 99 billion tokens, 16.83 billion tokens, including the airdrop, are reserved for community incentives.

Visit 99Bitcoins Presale

4. Waves (WAVES)

Waves is a blockchain technology that offers a user-friendly platform for creating and customizing digital tokens effortlessly without coding skills. It makes token creation accessible to many participants, transforming blockchain technology. Its native token, WAVES, serves as the backbone of the protocol, powering transactions and incentivizing network participation. It facilitates token launch as digital assets, supporting decentralized applications (DApps) and smart contracts.

The Waves protocol operates through full and lightweight nodes, ensuring data integrity and network interaction. It finds applications in various sectors, including national currencies on the blockchain and crowdfunding for community-based projects. Waves foster decentralized solutions by providing a platform for managing financial and organizational aspects. It facilitates managing financial flows and issuing securities, bringing efficiency and accessibility to traditional financial processes.

🌊 Another batch of top liquidity pools on #Waves for your consideration! 🚀

WIND / $WAVES 👉https://t.co/E7EmAsIDIE

BNB-BSC / $USDT 👉https://t.co/3bkxWCVpyU

L2MP / $XTN 👉https://t.co/g6ENef2Pf4$WEST / WAVES 👉https://t.co/4WeqS3yXFT$PWR / WAVES 👉https://t.co/akKe3LvVSJ… pic.twitter.com/HQO6k6rfxS— Waves 🌊 (@wavesprotocol) April 29, 2024

Despite a 33% increase over the past year, Waves trades 6.03% below the 200-day moving average. With a neutral 14-day Relative Strength Index (RSI) at 56.14, Waves may trade sideways. However, investor sentiment may be positively influenced at $2.47, with a 4.48% rise in the last 24 hours. Additionally, 47% of the last 30 trading days were positive, suggesting underlying strength. With high liquidity and a volume-to-market cap ratio of 3.4312, Waves presents opportunities for investors.

5. Amp (AMP)

Amp is an open-source, decentralized protocol offering collateral as a service, aiming to provide instant, verifiable assurances for various value transfers. It tackles network challenges like slow confirmation times and price volatility, offering a fast, efficient, and secure transaction platform. Amp introduces collateral partitions and managers, facilitating verifiable collateralization and enabling diverse use cases. Its predefined partition strategies further enhance flexibility, allowing tokens to be staked without leaving their original address.

Amp’s uniqueness lies in its decentralized, open-source ecosystem, which decentralizes risk through smart contracts and integrates value transfer and assets. Merchants can accept crypto payments with insurance against fraudulent activities through the Flexa network. Furthermore, Staked AMP tokens act as collateral, protecting buyers and sellers.

Thank you to the amazing Ampera community for your support at @EthereumDenver! Your enthusiasm fuels our mission to drive the new era of payments. pic.twitter.com/OUqTyBSRzb

— Ampera (@ampera_xyz) March 14, 2024

It has surged by 153% over the past year, with a significant 25.73% increase in the last 24 hours. Trading 247.80% above the 200-day moving average shows signs of being overbought with a 14-day RSI at 76.08. Despite this, the gainer exhibits moderate volatility, with a 30-day volatility of 13%. With high liquidity, Amp presents opportunities for investors. It offers exposure to a decentralized collateralization protocol with a volume-to-market cap ratio of 0.2721.

Read More

- Biggest Crypto Gainers

Comments

Post a Comment