Machine learning algorithm predicts XRP price for February 29, 2024

With the majority of assets in the cryptocurrency sector experiencing a price pullback, the trend seems to be particularly bearish for XRP. However, machine learning and artificial intelligence (AI) algorithms predict its recovery as soon as by the end of February.

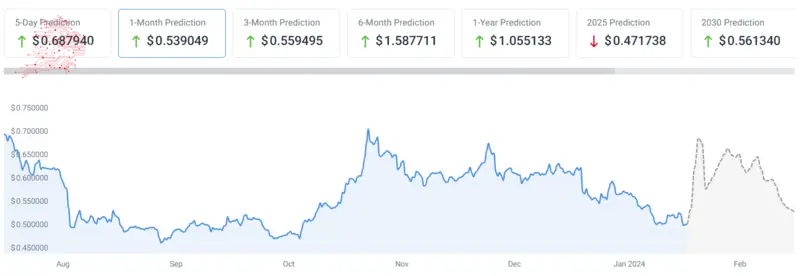

Indeed, the price of XRP could improve during February, ending up at $0.5436 on February 29, 2024, according to the projections by advanced price prediction algorithms deployed at the crypto and stock analytics and prediction platform CoinCodex and accessed by Finbold on January 31.

Should the above forecast, based on the historical XRP price dataset, i.e., the positive and negative trends in the past, prove correct, it means the sixth-largest asset in the crypto sector by market capitalization would be trading at a price 7.64% higher than currently.

XRP price analysis

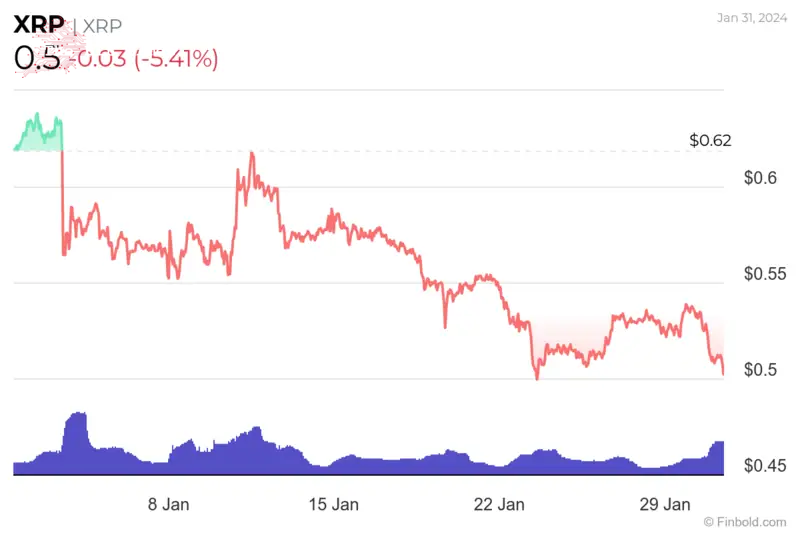

Meanwhile, XRP was at press time changing hands at $0.505, which suggests a decline of 5.41% in the last 24 hours, in addition to losing 2.53% over the previous seven days and dropping 18.45% across the past month, as the recent charts indicate.

Elsewhere, the one-month technical Analysis (TA) gauges over at the finance and crypto monitoring platform TradingView are not as bullish on XRP as the machine algorithms, suggesting a ‘sell’ at 8, summarized from moving averages (MA) pointing at ‘neutral’ and oscillators in the ‘sell’ zone at 7.

In conclusion, the crypto asset at the center of a long-running court standoff between the United States Securities and Exchange Commission (SEC) and Ripple could increase its price soon, particularly with the blockchain company seemingly preparing for involvement in the exchange-traded fund (ETF) space.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment