Record: 3 out of 4 Bitcoins are held by long-term investors

Bitcoin (BTC) has been trading in what is usually called an “accumulation zone”, ranging from $24,756 to $31,818 since mid-March 2023. During these last six months of low-price activity, short-term holders liquidated their positions, while high-conviction long-term holders increased their share of Bitcoin’s limited supply.

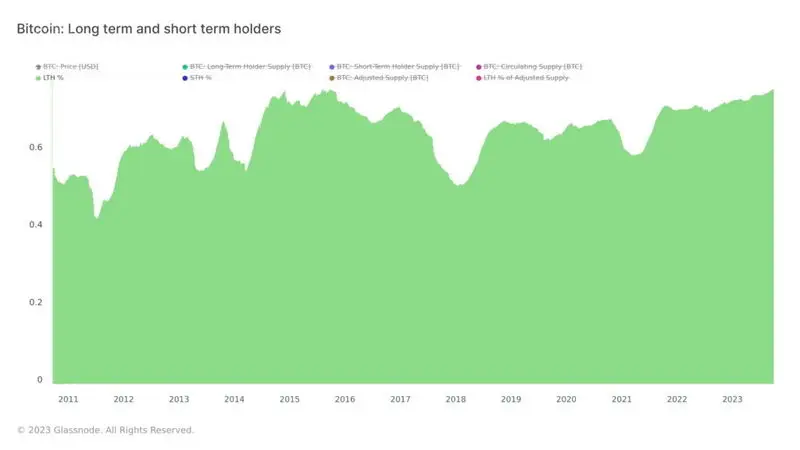

Co-founder of Reflexivity Research, Will Clemente, shared a Glassnode chart on September 28 on X (formerly Twitter) showing that three out of every four Bitcoins in circulation are now in the hands of what Glassnode calls ‘Long Term Holders’.

“There it is – The percentage of Bitcoin supply held by long-term holders just officially reached its highest level ever at 76.09%.”

— Will Clemente (@WClementeIII)

According to the Glassnode metric’s description, long-term holders are crypto wallet addresses that received and are holding Bitcoin UTXOs for longer than 155 days. Interestingly, Glassnode Academy says that after a 155-day holding, Bitcoin addresses are less likely to spend their coins.

While short-term holders come and go looking for quick profits in high volatility scenarios, long-term holders are in for the bigger game, often using a dollar-cost averaging strategy, buy and hold strategies, or what is called position trading — in opposed to swing trading or day trading, that are more of short-to-mid term trading strategies.

Bitcoin price analysis

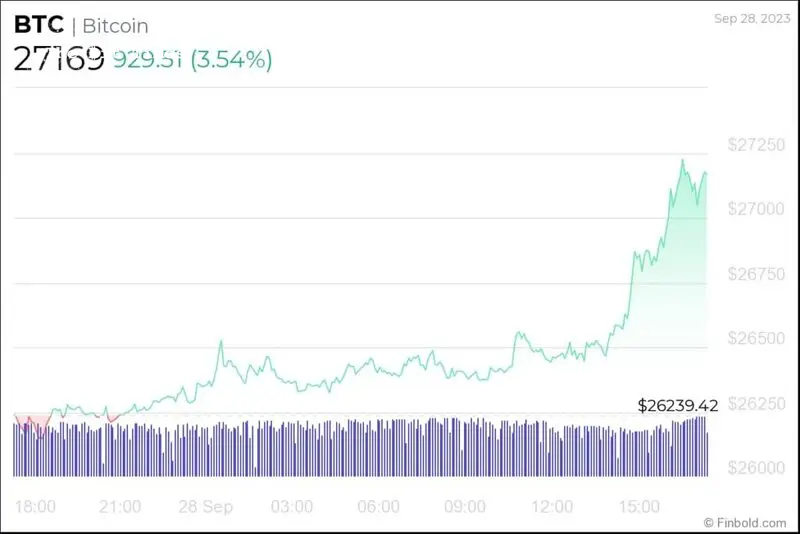

Meanwhile, BTC has again crossed the $27,000 price mark, being traded at $27,169 per coin on a remarkably positive day. Accruing for 3.54% gains in the last 24 hours.

As fewer Bitcoin investors are willing to spend (or sell) their coins at record levels, the price of the leading cryptocurrency has started rising with a recent increase in the demand for BTC on the crypto market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment