How this mining pool strives to make Bitcoin greener

Bitcoin (BTC) miners consume massive amounts of energy to secure the network and process transactions. While the network offers many benefits, like banking the unbanked, Bitcoin’s energy consumption is a controversial topic for critics. However, new solutions are emerging to reduce the environmental impact of Bitcoin mining.

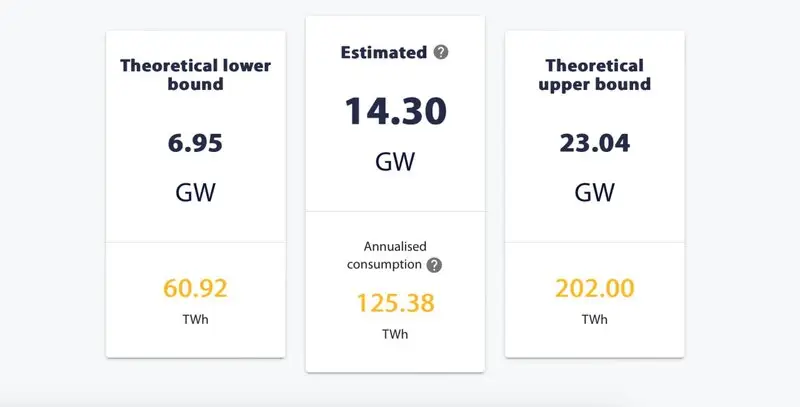

The Cambridge Center for Alternative Finance estimates that the Bitcoin network currently consumes about 109.34 terawatt-hours (TWh) per year. Bitcoin miners use this Energy to generate hash keys. When they guess the correct key, they receive BTC as a reward for their contribution to securing the network.

Cambridge Center for Alternative Finance

The current electricity demand is at record heights, and there is a new influx of miners. However, many miners still rely on fossil fuels, contributing to the network’s reliance on dirty energy sources.

Environmental concerns

Most of the world is pursuing a green transition, stepping away from fossil fuels as much as possible. With Bitcoin relying on its proof-of-work (PoW) protocol, the network is targeted by critics like Greenpeace, as it does not align with the organization’s mission to make the world’s industries more sustainable. In addition, Bitcoin’s reputation is at stake, with governments mulling over strict regulations for the mining industry and brands like Tesla dropping BTC as a payment method.

In other words, this stride for sustainability is also relevant for the Bitcoin mining community. A switch to sustainable energy sources seems like a logical step to take, but it isn’t the easiest. In many countries, fossil fuels are simply the cheapest option, making them the first choice for miners.

Currently, many different initiatives are pushing Bitcoin in a greener direction. For example, miners can minimize methane’s environmental impact by converting flared methane and vented landfill gasses into electricity. What’s more, smaller miners can now also contribute to the green effort by joining mining pools like PEGA Pool.

Accelerating Bitcoin’s green future

PEGA Pool, a platform based in the United Kingdom, is one of the newest mining pools in the industry. Of course, mining in a network, joining forces with other miners and earning BTC together is nothing new. PEGA Pool, however, offers miners a way to make their operations more sustainable.

There are several ways this mining pool makes the work of participating miners more sustainable. First, miners that use sustainable energy resources get a 50% reduction in pool fees, giving clean energy sources an advantage over other participants in the PEGA mining pool.

Secondly, miners using “dirtier” energy sources are also welcome to join. However, PEGA Pool reserves a portion of the fees these miners pay to offset their environmental impact. More specifically, the project uses the fees to plant new trees, which capture the carbon these miners emit while mining Bitcoin.

PEGA Pool might be a relatively new platform, but its green mission has already attracted many miners. According to blockchain explorer BTC.com, the pool already ranks among the biggest mining pools in the industry, taking the 11th spot on the list. Currently, it produces a hash rate of 2875.62 peta hashes per second, closely following Poolin. The pool has already mined 771 Bitcoin by mining 121 blocks, all with minimal environmental impact.

Green initiatives like PEGA Pool may positively impact the future of Bitcoin, even if it is unlikely that Bitcoin will join Ethereum in its transition to a proof-of-stake (PoS) protocol. However, mining can become a more sustainable industry by focusing on renewable energy. In turn, it can increase the demand for renewable energy, possibly benefiting more than just the miners themselves. Miners looking to make their operation greener can find more information about PEGA Pool on its official website.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

Comments

Post a Comment