2022’s Market Review: Crypto Economy Loses $1.4T, Top 10 Token Knockouts, Terra’s Collapse

2022 is coming to an end and during the last 12 months, the crypto economy has lost roughly $1.486 trillion in value against the U.S. dollar. On Dec. 20, 2021, bitcoin was trading for $46,406 and it has lost more than 63% in value year-to-date, while the second leading crypto asset ethereum shed 69% against the greenback over the last year.

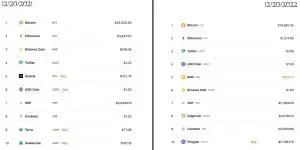

2022’s Top Ten Cryptos Shed Billions While a Few Played Musical Chairs

Approximately 365 days ago on Dec. 20, 2021, the crypto economy was worth a lot more in value than it is today. 12-month statistics indicate that $1.486 trillion has been erased from the crypto economy since that day, as it slid from $2.334 trillion to the Dec. 20, 2022 value of $848 billion.

At the time, bitcoin’s (BTC) nominal value measured in U.S. dollars was around $46K per coin and ethereum (ETH) was priced at $3,847 per unit last year. 24-hour global trade volume was also much larger, as $118 billion in trades were recorded on Dec. 20, 2021.

Today, the global trade volume has been sliced in half, as there’s been roughly $48 billion in swaps recorded on Dec. 20, 2022. Last year at this time, the top ten crypto market cap looked a whole lot different.

A number of tokens have been displaced from the top ten, while new coins have been added. The top ten largest crypto market caps last year included bitcoin (BTC), ethereum (ETH), bnb (BNB), tether (USDT), solana (SOL), usd coin (USDC), xrp (XRP), cardano (ADA), terra (LUNA), and avalanche (AVAX), respectively.

12 months later, SOL has been kicked out of the top ten, LUNA imploded and spiraled below a U.S. penny per coin, and AVAX was pushed out of the top ten standings as well. On Dec. 20, 2021, only two stablecoins existed in the top ten, and today — and for the first time in history — three stablecoins are included in the top ten spots.

Top ten stablecoin assets back then were USDT and USDC, and in June 2022, BUSD managed to enter the top ten positions. New entries into the top ten at this time include dogecoin (DOGE) and polygon (MATIC).

Last year at this time, tether (USDT) had a much larger market valuation at $77.39 billion, while today it stands at $66.22 billion. USDC’s market cap has increased during the last 12 months from $42.21 billion to the Dec. 20, 2022 market valuation of $44.43 billion.

365 days ago, BUSD’s market cap was $14.54 billion and it stands at $18.06 billion today. Besides LUNA, two coins that were once top ten contenders — solana (SOL) and avalanche (AVAX) — have suffered considerable losses during the last 12 months.

Year-to-date, SOL has shed 93.2% against the greenback and AVAX has lost 89% this past year. SOL has notched down from the fifth largest market cap to the current 18th position. AVAX was holding the number ten spot last year and currently, AVAX is coasting along in the 20th spot.

While dogecoin (DOGE) is a top ten contender today, it had a much larger market cap when it was not included in the top ten standings. Dogecoin’s market valuation has slipped from $21.78 billion to today’s $10.22 billion.

Polygon too, which is now a top ten coin, used to have a $14.7 billion market cap on Dec. 20, 2021, but today the market valuation is down to $7.16 billion. The only anomaly of the small handful of cryptos that got added to the top ten and managed to increase its market valuation was the stablecoin BUSD.

12 months ago, when the crypto economy’s market cap was $2.334 trillion, BTC had a dominance rating of around 38.4% and today it stands at 38.3%. While BTC’s dominance didn’t really flinch, ETH’s dominance, on the other hand, moved from 20.2% to 17.3% over the last year.

Comments

Post a Comment